Why Do I Coach With YNAB?

- Eric Hout

- Jun 17, 2024

- 6 min read

Updated: Oct 19, 2024

Whenever I go to a restaurant and see a multi-page menu put in front of me, I jokingly say, "Just make it easy and give me 5 options. I'll pick from those!" I tend to be someone who tries to sift through all possible options, and even after making a selection I sometimes wonder if I really made the best decision! Selecting a budgeting app can feel the same way. There's no shortage of personal budgeting tools and techniques available today, so how do you know the one you're considering will best meet your needs? In this post I'll lay out the reasons why I personally budget using YNAB and why, by extension, YNAB is my default tool when I'm doing budget coaching with others.

We'll start with the most significant reason. I've used YNAB for the past 10 years, and it has been with me through both significant and ordinary life events. I've used YNAB for "big ticket" things like a wedding, paying off student loans, buying a house, purchasing major appliances for the house, adopting a puppy, and purchasing vehicle replacements for my wife and I. It helped us through the loss of my wife's income during the pandemic. It gave me confidence when getting my first job out of college, switching to a new one several years later, and launching New Trajectories. YNAB helped us breathe easier during a trip to the pet emergency clinic and a nearly 25-percent annual increase to our apartment's rent. It's helped me track our off-budget accounts like retirement and HSA without feeling the need to stress about their balances. It's even been super handy for me in remembering what gift cards I have (I tend to put gift cards in my wallet and completely forget about them until I see them tracked in YNAB). I've even used YNAB to get an idea for the values of our vehicles and track how much is in our mortgage escrow at any given time. That's not to mention the ordinary day-to-day things, like groceries, household supplies, doggie toys, and annual subscriptions. YNAB has also allowed us to make charitable giving a priority in a way that is not an afterthought. As we move forward in life and both unexpected and routine expenses continue to come up, I'm confident of YNAB's ability to help us. As a coach, I want to say I practice what I preach - I'm helping you with a system that has worked wonders over the years for us and can also work wonders for you.

The other big reason I am a YNAB user and coach is because YNAB is not just a tool or an app. It's first and foremost a methodology of personal finance management. The app has been built strategically around a methodology of four "rules." How many other budgeting apps out there can you confidently say are built around a proven methodology? On average, YNAB claims it helps the average user save $600 by their second month of use and $6,000 in the first year. The methodology works!

Most budgeting systems out there are built around one of three mindsets:

Allocation - Assigning dollars to specific jobs. (An example of an allocation method is "the envelope method," where you put all of your cash into envelopes set aside for specific jobs, like groceries or household supplies.)

Forecasting - Making a plan for your money based on what you think you are going to have.

Accounting - Tracking inflows and outflows in your spending.

YNAB uniquely blends these three mindsets into one methodology:

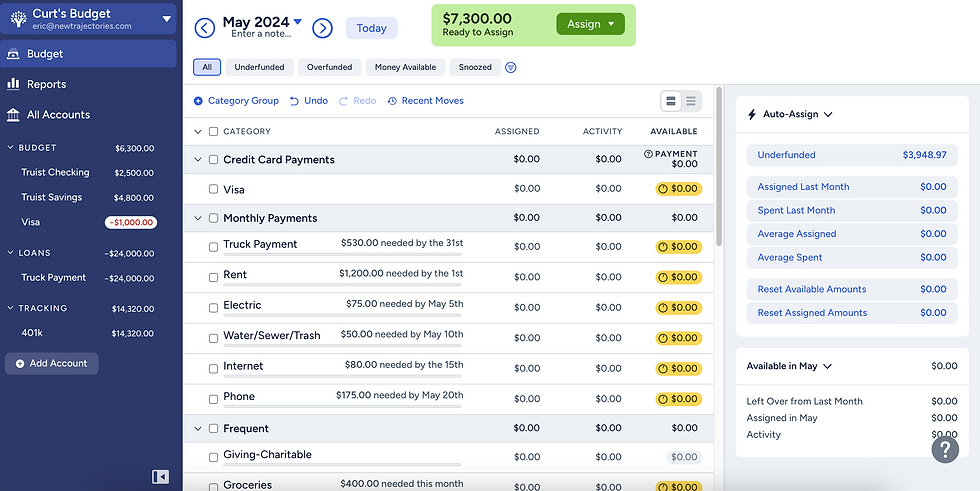

Allocation - YNAB maintains a "zero-based budgeting" mindset by allowing you to only allocate the dollars you have right now.

Forecasting - YNAB allows you to make a plan through the use of targets. YNAB also allows you to schedule transactions or paychecks you expect will happen in the future (but you shouldn't enter the paycheck into the budget until the money arrives).

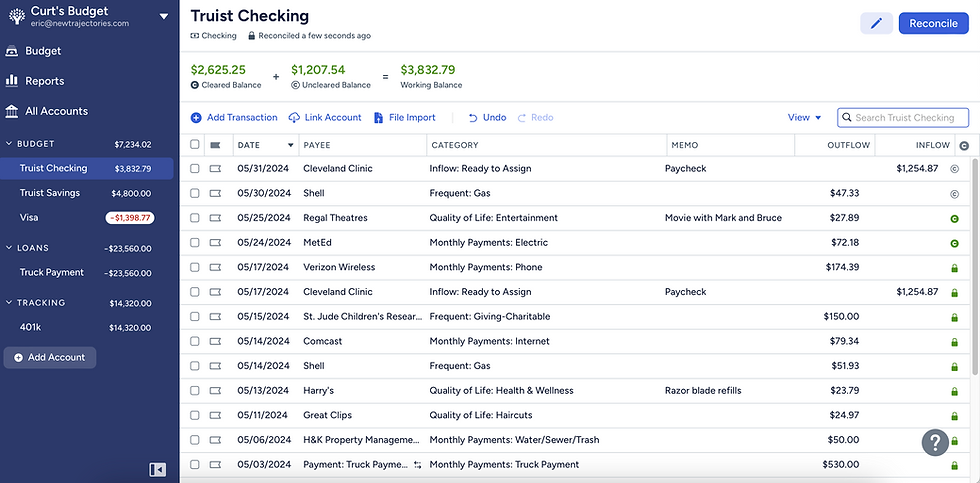

Accounting - YNAB can track your income and spending through its use of reports and account ledgers.

Some budgeting apps out there have a focus on accounting, giving you nice-looking charts showing where your money went last month or last year. This is great. The trouble, though, is that you can't successfully drive a car by looking in the rearview mirror. While knowing how you spent your money in the past is helpful (and may give you some guilty feelings that spur you to make changes for the future), looking at data from the past does not actually help you plan for the future or prioritize the funds you have right now.

By definition, forecasting and allocation tend to be opposites. Forecasting doesn't allow you to consider the current state of your money, while allocation isn't future focused. I've found that some budgeting apps out there will combine the "forecasting" and "allocation" mindsets, allowing you to allocate your dollars based on what you think you will have by the end of the month. The trouble with that approach, though, is that the future hasn't happened yet. Let's say you expect you are going to get a $500 paycheck on June 30, and allocate this $500 into a "clothing & shoes" category in your budget. You spend the $500 on clothing on June 15. What happens if June 30 rolls around and you never get paid because you unexpectedly lost your job on June 20? Then what? I believe YNAB correctly separates forecasting from allocation.

When I work with clients, the "forecasting" is done during the onboarding process by setting category-specific targets based on what the client thinks is a realistic dollar amount or timeframe to shoot for on each category. The trick here is that we are not working with actual dollars at this step. Once we add accounts, we can then "allocate" the dollars in those accounts based on the targets previously set. If a client doesn't have enough funds in their accounts to cover all of their targets, that's ok; the client will figure out very quickly which goals are the most important right now and which can wait until more money arrives.

Several years ago, there was a period where I looked around to see if I could find any budgeting apps that seemed to be better than YNAB. The result: I couldn't find anything remotely comparable to YNAB. I'll also look into new budgeting apps that come onto the market today, but none have come close to toppling down YNAB as the budgeting "king" in my life. (Although, many other apps do have features that seem to be a bit of a knock-off from what YNAB already offers, which helps me be confident I made a good decision in choosing YNAB.)

There are a lot of other budgeting apps out there that are simply allocation-focused. If I didn't have YNAB in my life, truth be told, I think I'd probably be on one of those other allocation or zero-based budgeting systems. But, I think I'd miss the YNAB-benefits of being able to plan ahead and set targets so that I have a visual of what I previously said my current plan would be. I think I would also miss the ability to see YNAB's handy-dandy charts, including a summary of my spending or seeing how many years left I have on my mortgage. Truth be told, YNAB is a one-stop shop for a comprehensive picture of my past and present financial life while giving good insights into what my financial future may look like.

Are there people out there who have struggled to use YNAB? Yes, of course. But so far in coaching, I've found that many people who are struggling with YNAB either haven't had a full understanding of YNAB's four rules or need some help implementing good habits to make their YNAB budgeting journey "stick." Once the rules are understood and good habits are in place, clients tend to be successful.

If your system of money management hasn't been working and you are ready for a change, feel free to take a look at YNAB or contact me. And if you are a current YNAB user and have questions or are struggling to get the software to work for you, feel free to reach out! I would love to help guide you toward a better (and proven) way of managing your finances.

Comments